Page Not Found

The page /specials/trade.php does not exist.

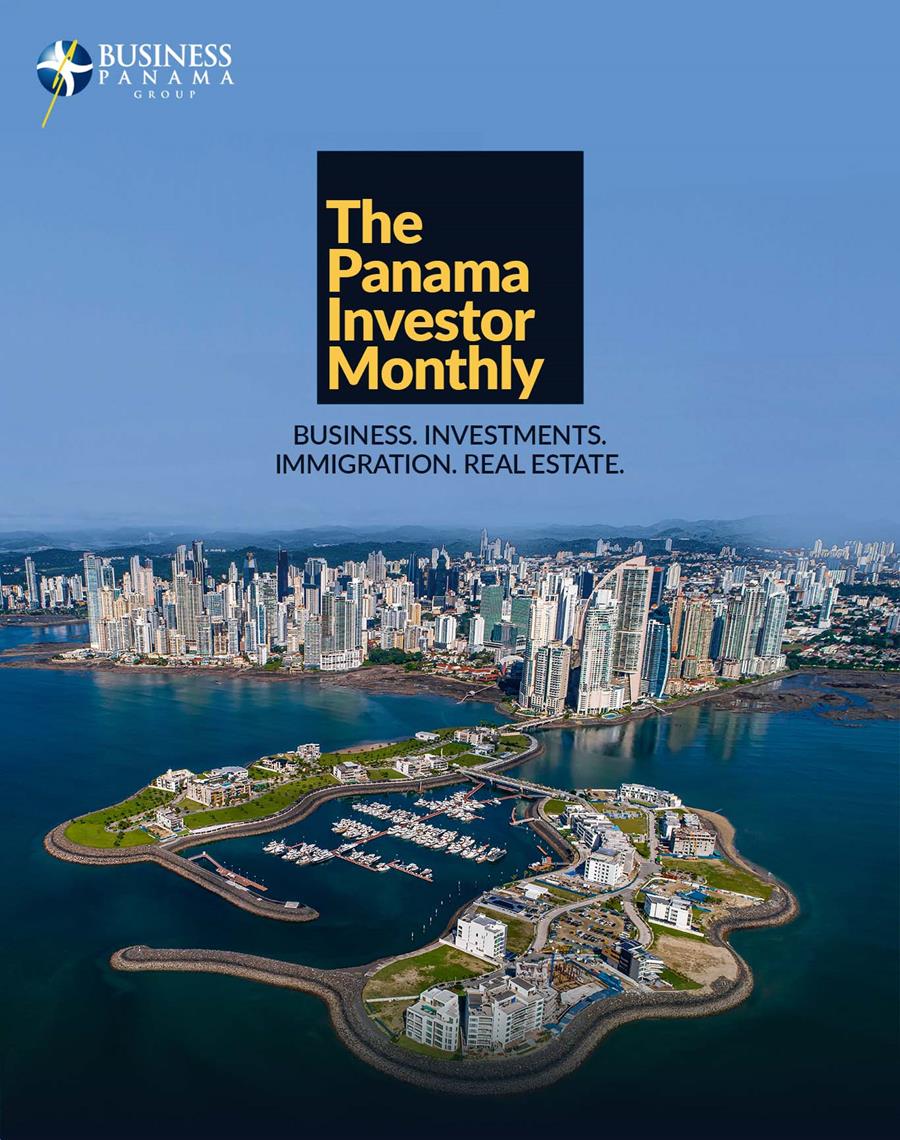

Doing Business in Panama 2026

An essential reading for the investor or company setting up a business for first time in Panama. Get our guide Doing Business in Panama completely FREE on the link below.

DOWNLOAD NOW!