Benefits of Retiring in Panama

Considered to be the best retirement program in the world, the Panama Pensionado program offers retirees excellent incentives including:

- Import tax exemption for household goods

- Tax exemption to import a new car every two years

- 25% discounts on utility bills

- 25% discount on airline tickets and 30% on other transportation

- 15% discount on loans made in your name

- 1% reduction on home mortgages for homes used for personal residence

- 20% discount on doctor’s bills 15% on hospital services if no insurance applies

- 15% off dental and eye exams

- 10% discount on medicines

- 20% discount on bills for professional and technical services

- 50% discount on entrance to movie theaters, cultural and sporting events

- 50% discount at hotels during Monday to Thursday, 30% on weekends

There are many more discounted items than we have space to list here. Once you have qualified as a Panamanian resident with a pensioned visa you qualify for these benefits.

Click here to view all general requirements to qualify for a pensioned visa are listed on However, the main requirement is proof of a minimum income of $1,000 per month plus an additional USD100 for each dependent. This program is not age related provided you have a pension. Foreign residents of Panama, regardless of the type of visa they obtain, who are over the age of 55 years for a woman and 60 years for a man, are entitled to most of the retiree incentives listed above with the exception of the importation of tax free cars.

Below is a summary of the different Visa & Residency programs available in Panama. If you wish to view any specific program, just click in the Link.

| Visa Program | Basic Requirement | Benefits |

|---|---|---|

| Self-Economic Solvency (Person of Means) |

|

Grants 2 years of temporary residency and eligibility for Permanent Residency. Right to apply for Panamanian nationality and passport after 5 years. |

| Retiree (Pensionado) | Pension of at least $1,000/month (+$250 per dependent) | Permanent Residency, tax exemptions on imports, senior discounts, and right to apply for nationality after 5 years. |

| Reforestation Investor (Option 1) | Investment of $100,000 in a certified reforestation project | 2 years of temporary residency, with eligibility for permanent residency and nationality after 5 years. |

| Reforestation Investor (Option 2) | Investment of $350,000 in a reforestation project | Immediate permanent residency and work permit eligibility; nationality after 5 years. |

| Qualified Investor | US$500,000 in real estate or securities, or US$750,000 time deposit (5-year minimum) | Immediate permanent residency and eligibility for nationality after 5 years. |

| Friendly Country Visa | Purchase real estate or set up a US$200,000 time deposit (3 years), or hold a labor contract with a Panamanian company | 2 years of temporary residency followed by permanent residency; nationality after 5 years. |

| Employment Visa | Must be employed by a company within the 10% or 15% foreign employee quota | 2 years of temporary residency and work permit, leading to permanent residency and nationality after 5 years. |

| Free Trade Zone Investor | Investment in a Free Trade Zone or Call Center (amount varies by zone) | 2 years of temporary residency, leading to permanent residency and nationality after 5 years. |

| Professional Activities | University degree for a profession not restricted under Panamanian law | 2 years of temporary residency, leading to permanent residency and nationality after 5 years. |

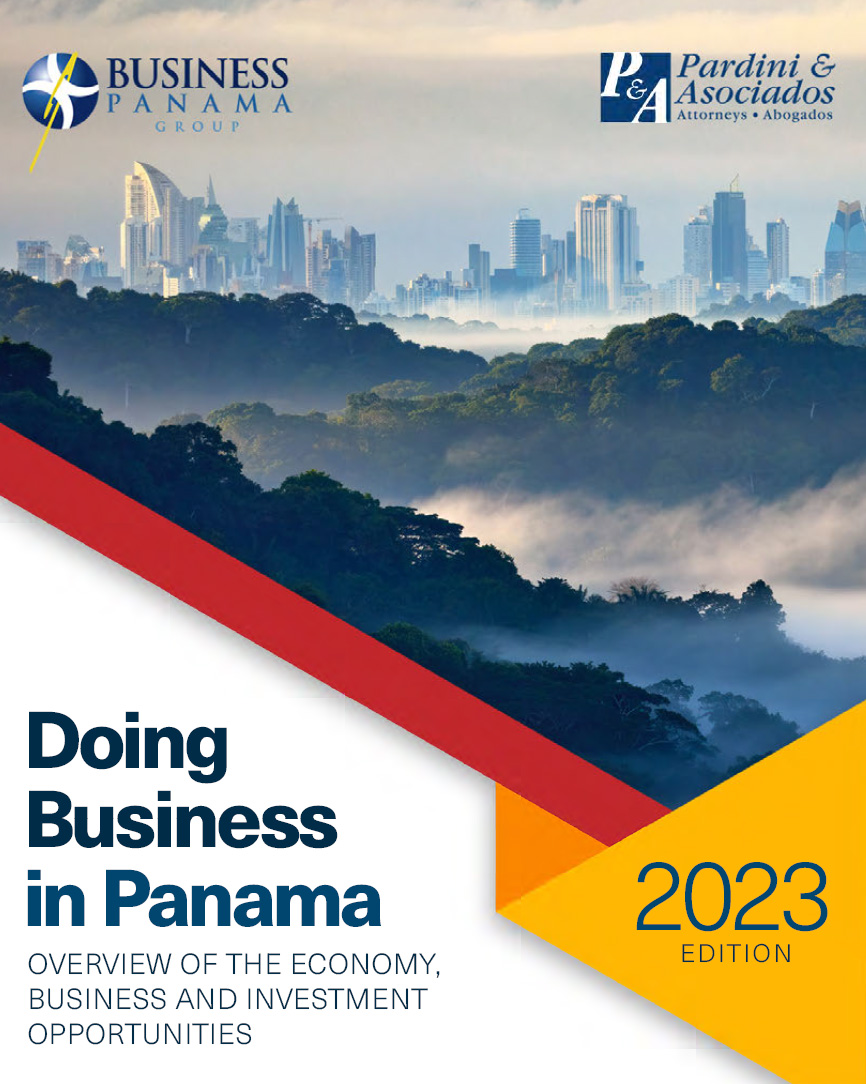

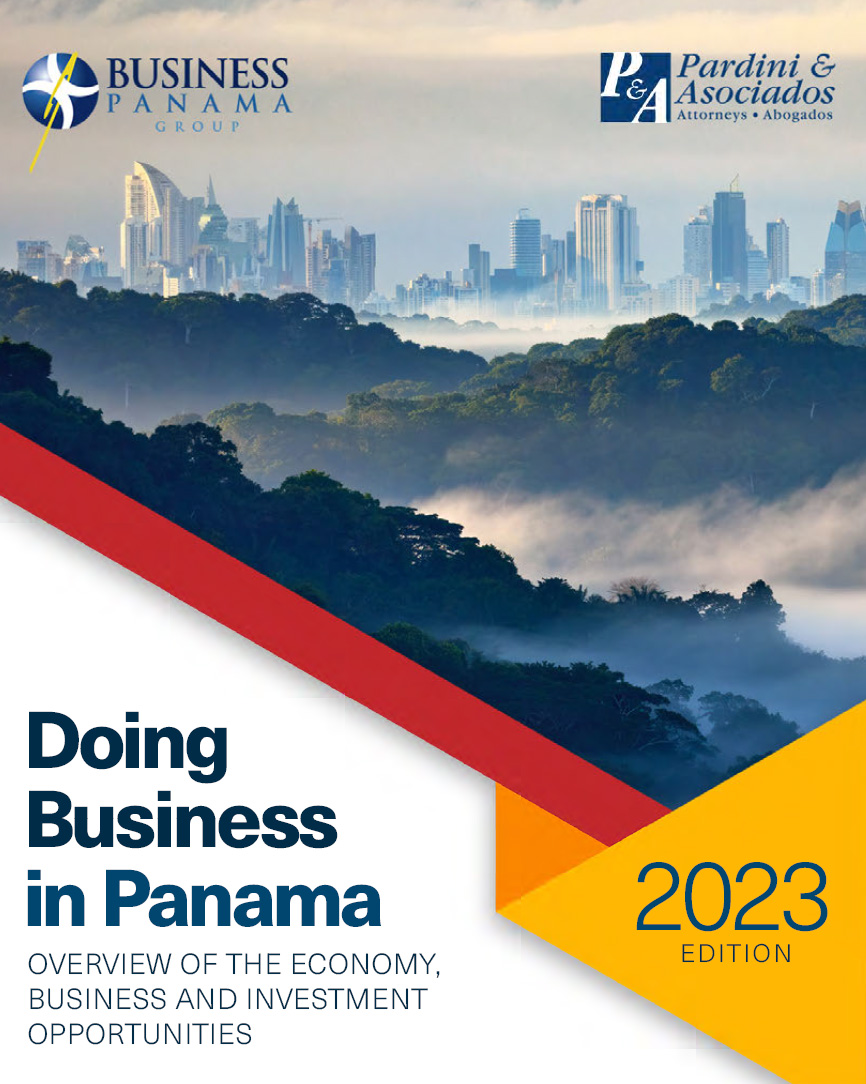

Business Panama Group together with Pardini & Asociados

provides a convenient One Stop Shop offering the services of...

Doing Business in Panama 2025

An essential reading for the investor or company setting up a business for first time in Panama. Get our guide Doing Business in Panama completely FREE on the link below.

DOWNLOAD IT NOW!